The not-complicated way to build wealth

You want to build wealth?

I definitely want to build some wealth. I'd guess about 98%* of folks out there would like to build wealth. The remaining 2% either were born into it, won the lottery or just had their startup bought by some big company. Some of that 98% already know what they're doing and they're just grinding away, but everyone else is scrambling around in the dark trying to figure things out.

It's a confusing personal finance jungle out there. There are so many articles telling you what you need to be doing or avoiding to build wealth that it's hard to know where to start. And since there is no one-size-fits-all way to go about handling your finances, it's hard to know which ones apply to you and when they apply to you (someone just out of school might need different advice from someone working for 20 yrs).

Managing money and learning how to build wealth are fundamental life skills that we need to learn on our way to adulthood. Sadly, it's not something usually taught in schools and a lot of parents don't know enough to teach their kids these necessary skills. So today, we're going to go over a simple framework to get a grasp on all things money. When it comes to money matters, try to put them into one of these four categories:

Quicksand - If you fall into quicksand, and you don't actively try to get yourself out, you can soon be in over your head (literally!). This category is for debt, but the most dangerous kind of debt and the easiest to get into - the kind that usually has high interest rates and the balance can grow over time. The most common form of this is credit card debt but payday loans also fall into this category. If you carry a balance on your credit cards, you get charged interest each day and what's worse, they'll even charge you interest on yesterday’s interest. A quick question to ask to recognize whether something is quicksand is this - is it possible for the balance you owe to get bigger? If yes, it’s quicksand.

Holes - I tried to find a different word for this: pothole, trench, crater, pit… but every word came with a connotation I didn’t intend, so ‘hole’ it is. A 'hole’ is a hollow in the ground - it doesn't grow. It just sits there patiently waiting for you to fill it in. This category is debt, but the kind where you borrow a specific amount of money and then slowly pay it down. The most common forms of this are mortgages, student loans or car loans. This debt category has two key features that set them apart from the category above - the borrowed amount (loan principal) never increases and interest is calculated only based on the borrowed amount, never based on last month's (or yesterday's) interest.

Water - Water is generally considered stable, but if left out long enough, eventually evaporates and disappears. This category is all the money you have sitting around in non-investment accounts (like checking, savings accounts and money market accounts). This also includes money hidden under the mattress. It is any money or assets that you have not earning more than 3% interest (or whatever the current inflation rate is). If you save up $100,000 and keep it in a checking account and don't touch it for 23 years, it'll roughly lose half its purchasing power and only buy you the equivalent of 50K worth of today's stuff. So while savings is really important, if you want to build wealth, you can't just save a lot because it evaporates - you need the next category.

Bunnies - Ever hear of ‘breeding like bunnies’? Bunnies can start breeding when they’re only months old and once knocked up, pop out babies in 30 days! In the first months, your bunnies get busy and make bunny babies. Months later, the baby bunnies are getting busy but the parent bunnies are still getting busy too and…. more bunnies! This category is for money you have that earns interest and then the interest earns its own interest - this is called compound interest. Most people who have built and maintained wealth have learned to use this category. Some things that fall into this category are stocks, bonds and mutual funds. Anything that can and usually does earn more than the inflation rate. This is how the rich get richer - or what they mean by making your money work for you. It's the only category where your wealth is grows while you sleep.

So, you've been reading this far and waiting for this not-complicated way to build wealth, here it is...

Get out of quicksand! Eliminate everything from the quicksand category. This type of debt is wealth cancer - you must avoid it at all costs if you want to build wealth. Do not carry a credit card balance. If you are carrying balances on this type of debt, get up now and start looking for solutions. Pay off bills that are incurring late fees and interest charges. I highly recommend looking for some type of financial counselor (or fiscal therapist? =P) to help you. Sometimes, it's not just about budgeting and self-control, but it's about accountability. I also want to just mention here that for certain seasons of life (job loss or illness, for example) or for folks living closer to the poverty line, it might be hard to live without this category. There are times when you use this category to just survive - and that’s fine. But when you leave those conditions and make more money, make sure to leave this category behind too.

Fill the holes and don’t retain water. To build wealth, it's best not to have even regular debt but if you do, it's preferable to have the lowest interest rate possible. I'd go as far as to say, in order to build wealth, you probably should only have a mortgage, no car or student loans. Now, to be reasonable, someone just graduating from school is likely to have student loans for quite a few years. So maybe you cannot reach the place where you eliminate all other forms of regular debt until 10+ years into your career. But it's definitely a milestone you should hit on the path to growing wealth. As for minimizing the water you retain, remember that money that just sits has its purchasing power slowly evaporating away. I'd recommend to only keep day-to-day living expenses, emergency funds and soon-to-be-used (in the next 1-5 years) money, like a down payment for a house, in these water-type accounts.

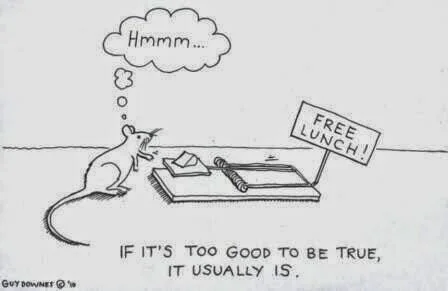

Turn every remaining penny into a bunny. Simply, take all money that isn’t day-to-day spending or emergency/soon-to-be-used savings and invest it (I’m not gonna give you advice on how to invest because that is not my wheelhouse). When it comes to investments, my usual advice is “don’t invest money that you're not willing to lose”. I still stand by that advice. But how do you build wealth if you are not willing to lose any money? Hmmm.. this is a tough one. At first I was tempted to say, if you're not willing to lose any money then you don't have what it takes to build wealth. But that's too harsh. So, instead I'll say, the easier path to building wealth involves investing. For those unwilling to lose any money, the path is really narrow and involves working really hard, learning a lot about less-risky investment options and making a LOT more money than the folks on the easier path. When you invest your money, you are making your money work to earn you more money. If you don't invest, you'll have to take on all that work yourself. And in this category especially, time is money.

Last, but not least, be patient and put in the hard work. If you are just beginning on this building-wealth journey it’s going to take a long, long time. When I work with clients through step 1, it often takes a year or two (or more!) to get out of quicksand debt. Many folks are just surviving, making student loan and mortgage payments and can barely build up an emergency fund. I mentioned in step 2 that paying off student loans could take over ten years! I said this framework is not complicated, but I never said it was quick or easy. Focus on daily small steps and celebrate milestones.

We will all suffer setbacks, but if we just keep focusing on the daily small steps, we’ll get there.

* This is a made-up statistic for illustrative purposes only.